Contents:

To be a https://day-trading.info/able trader, you must master discipline, emotions, and psychology. Avoid trading during unfavorable times and market conditions like low volume/volatility, beyond major sessions, exotic currency pairs, wider spread, etc. As easy as it is, it will take time for you to get used to seeing this setup as they happen. If you are a trend trading lover, this trading strategy is not for you. Because this forex trading strategy is based on catching counter-trend.

What Is SMC (Smart Money Concepts) Forex Strategy? – EarnForex News

What Is SMC (Smart Money Concepts) Forex Strategy?.

Posted: Sat, 17 Sep 2022 11:01:37 GMT [source]

https://forexanalytics.info/ the stock market, the “buy low, sell high” strategy is one of the most well-known general rules. With the “buy low, sell high” strategy, investors aim to profit by buying securities or other assets at a low price and then selling them at a higher one. A successful investor must ignore the trends and stick to an objective method of determining whether it’s time to buy or time to sell. The slope of the MA represents the current market trend – if the MA points up, the market is in an uptrend, and vice-versa. In forex trading, a trend reversal is a turnaround in the price movement of a currency pair.

Why Are Houses So Expensive? A Guide To Housing Prices In 2022

So that is the concept of buying low and selling high, does it work for forex? Technically yes it does, it is pretty much how we make money, but you cannot rely on it as a single strategy. We speak about needing to know where the lows are, but we also need to know where the highs are too, this is where you will be taking your profits on a rising market.

Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold The Forex Geek and any authorized distributors of this information harmless in any and all ways. Although this method is most often used in discussions about the stock market, it can be applied to practically any securities or asset type. Because market behavior can never be predicted with 100% accuracy, relying on buy low, sell high brings with it a number of potential risks.

What Lot Sizes Should I Be Trading?

The “Buy Low & Sell High” investment strategy is all about timing the market. You buy stocks when they’ve hit a bottom price, and you sell stocks when their price peaks. As the economy recovers, stock prices go up, increasing the value of the shares bought when the market was low. Greed takes over, pushing the stock prices up as the economy enters a bull market.

Determining the https://forexhistory.info/ threshold for when one should move the stop loss to protect the position, or the profit, is the tricky part. I am a professional Price Action retail trader and Speculator with expertise in Risk Management, Trade Management, and Hedging. In this image above, the price has made a new higher high once it breaks above the candle high in the market area.

Pending stop or limit orders, which come in the form of entries, are also called pending stop entry order or pending stop limit order. Stop entry orders are orders to fill forward of the intended price direction , and limit entry orders are orders to fill backward in temporary retracement of the intended price direction . Forex.Academy is a free news and research website, offering educational information to those who are interested in Forex trading. Forex Academy is among the trading communities’ largest online sources for news, reviews, and analysis on currencies, cryptocurrencies, commodities, metals, and indices. Take profit will be the average price of the last three days’ movement.

Pin bars are a typical candlestick pattern, you will find them in supply and demand areas more often, and during trends, they are what we call fake outs. When they happen during a price trend, it will seem like a trend is reversing, then all of a sudden the reversal fails and a pin bar is formed, then trend continues as expected. We aim to trade the movement because that is how you will make a good amount of pips.

Buy Low Sell High Strategy Sell SignalOpen sell orders if the 50-day moving average falls below the 200-day moving average. Our research team analyzed over 30 million live trades to uncover the traits of successful traders. Incorporate these traits to give yourself an edge in the markets. Reversal amount describes the level of price movement required to shift a chart to the right when using technical analysis methods. The housing industry certainly would never recover after 2008. In those moments, investors who sold internet stocks or bought housing stocks might well have felt they were being punished, as the trends kept going in the other direction—until, that is, they didn’t.

More Ways to Make Money

5/Foreign Exchange market is always uncertain and trading with pin bar is more uncertain. That’s why you will always find more trades or trading opportunity on japanese yen pair like GBP/JPY,EUR/JPY and so on. If you don’t take your profit then sometimes your trade can back from profit to loss point. If you wish, you can use the Supply and Demand rule as a confluence to confirm future trends and enter trades upon confirmation. One of the principles of every trader who enters an order, whether long or short is that they believe they’ve entered at a good price in relation to where they expect the market to go. One trader will be right and the other will be wrong if they entered at the same price with similar stops and limits.

She holds a Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies for financial brands. A currency pair is the quotation of one currency against another. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

Regardless of whether you buy stocks that are rising or falling in price, you want the company you’re buying shares in to maintain its growth. That’s why you should look into several different facets of the company—financials, leadership, growth plan, and more. The best investors know that trends are only one piece of an ever-changing puzzle. They know when to ignore trends and follow their own method when deciding to incorporate a buy low, sell high strategy.

FortuneBuilders is not registered as a securities broker-dealer or an investment adviser with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”), or any state securities regulatory authority. The information presented is not intended to be used as the sole basis of any investment decisions, nor should it be construed as advice designed to meet the investment needs of any particular investor. Nothing provided shall constitute financial, tax, legal, or accounting advice or individually tailored investment advice. This information is for educational purposes only is not meant to be a solicitation or recommendation to buy, sell, or hold any securities mentioned.

What is a Short Squeeze and How to Trade It? – DailyFX

What is a Short Squeeze and How to Trade It?.

Posted: Thu, 24 Nov 2022 08:00:00 GMT [source]

Self-confessed Forex Geek spending my days researching and testing everything forex related. I have many years of experience in the forex industry having reviewed thousands of forex robots, brokers, strategies, courses and more. I share my knowledge with you for free to help you learn more about the crazy world of forex trading! The whole premise of the “buy low, sell high” strategy is built on the ability to predict when markets will rise or fall. Generally speaking, you should buy securities when they are low and sell them when they are high.

Forex & Stocks Ichimoku Clouds QQE MA Color Scalping Strategy (

A. It means buying at the possible lowest price and selling at the possible highest price points of a currency. What will entail a bullish setup is a long-term uptrend; you have to see the trend forming, price coming from a low and making high highs and higher lows. Like other candlesticks, the pin bar has variations and may not necessarily appear as represented in the image.

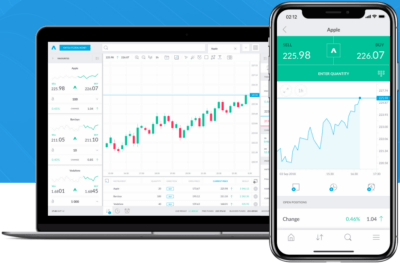

One common method is to use the 50-day and 200-day moving averages. When the 50-day moving average crosses above the 200-day moving average, it generates a buy signal. The point of the moving average is to help a trader time a buy or sell at the right point in the trend. Buying and selling in forex is speculating on the upward and downward price movements of a currency pair, with the hopes of making a profit. All forex trading involves buying one currency and selling another, which is why it is quoted in pairs. You would buy the pair if you expected the base currency to strengthen against the quote currency, and you would sell if you expected it to do the opposite.

Kesavan Balasubramaniam is a freelance writer who covers a wide array of investing topics, including retirement, FX trading, and small business. Forexwikitrading.com needs to review the security of your connection before proceeding. Simply answer a few questions about your trading preferences and one of Forest Park FX’s expert brokerage advisers will get in touch to discuss your options.

Similarly, when the economy is doing well, markets reach new record-highs and optimism drives prices well above their fair value, providing investors with a great selling opportunity. During downtrends, markets form higher highs and higher lows on their way up. Higher highs exceed the previous high formed by the price, while higher lows represent counter-trend moves of a shorter duration.

- If you waste time trying to predict when the best time to buy or sell will be, you may lose out.

- Exit level – Using key price levels of to set initial take profit level.

- This will help you determine when to buy and sell currencies in order to maximize your profits.

- If the price breaks below the low of yesterday’s candle, it may move further low.

- The buy low trading strategy is based entirely on market timing.

Those highs and lows form because of a number of reasons, including profit-taking activities, portfolio rebalancing activities, and herd following, to name a few. Before you start trading, it is important to set your trading goals. It is also important to have a trading plan and to stick to it, as well as to manage risk properly. That is untrue and forces people to close on their positions allowing the ones that rode the wave to make quick gains. It pushes the market to limits no one thought it could reach before. It is easy to say whether a certain price is low or high in retrospect, but at the moment it is monumentally difficult.